On July 21, 2017, the Wall Street Journal published an article titled “This Life Insurance Isn’t So Permanent”, which discussed instances where an insurance policy is paid out prior to the death of the insured per the terms of the contract. Specifically, they refer to the situation that a 99-year-old is currently in; his family will lose out of $3,200,000 in death benefit proceeds when he turns 100 years old in September. His Transamerica policy states that the policy’s cash surrender value will be paid out to the policy-owner upon the insured reaching maturity age (age 100 in this case). Many policy-owners are probably unaware that this could be a clause of their insurance policy and are in for an unpleasant surprise when their policy is paid out before their passing.

Older policies, such as those issued prior to the early 2000’s, were based on the 1980 Commission’s Standard Ordinary (CSO) mortality tables. These tables reflect the probability that people in various age groups will pass away in a given year. The insurance products that were based on these tables used age 95 or age 100 as the maturity date for the contracts. In some instances, once the client reaches the maturity age, all insurance charges cease at that point and the policy remains inforce until the insured’s passing. If the client is able to keep these policies inforce until maturity, they are guaranteed the policy’s death benefit will be paid when they pass away. The amount of continued coverage can vary as well depending on the design of the policy and product specifications.

However, other policies state that if the insured has not passed away by the maturity age, then the policy pays out its cash surrender value and will no longer pay out a death benefit. This can be a disastrous consequence for the policy-owner, who now loses out on the tax-free death benefit and the much-needed liquidity. Furthermore, since costs of insurance increase with age, there’s risk that the policy will have minimal cash value at the policy’s maturity. If this is the case, then most or all of the policy premiums that were paid into the policy will be lost as well.

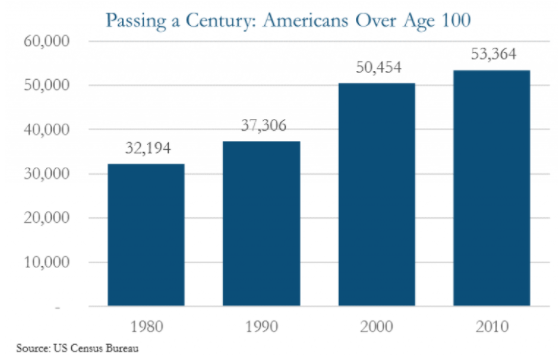

Years ago, this was not an issue for most consumers as very few people lived beyond 95 or 100 years old. However, with the improvements in medical care extending mortality, people are living longer than ever before. As evidenced in the chart below, the number of centenarians have increased over 43% between 1990 and 2010.

Fortunately, since the mid to late-2000’s, insurance carriers have created products based on the updated mortality tables. These new products now use age 121 as the standard maturity age. The primary reason for the change was to prevent an abundance of policies maturing before the insured’s death, as that is something that neither carriers nor policy-owners want to have happen. However, even with the new standard in the industry, there is an unknown number of older, existing policies that will be paying out their cash value instead of the death benefit.

While these payout provisions shouldn’t be a surprise since they are included in the policy documents, they can be missed or misunderstood by clients. Therefore, it’s imperative for policies to be reviewed frequently after the policy has been purchased. Unfortunately, post-acquisition due care is often one of the most neglected areas of purchasing life insurance. Contrary to popular belief, life insurance is not a one-time purchase that can be set on a shelf until the insured dies. It actually requires thorough, proactive and annual attention, and if it’s not properly cared for, it can be very costly.

If your clients have any older policies, it’s our recommendation a comprehensive policy review be performed to see what options they have for the future of their policies. While these policies may have been purchased under the premise of providing “coverage for life”, the terms and specifications are unique for each policy and will dictate how long the policy remains inforce. If the policy is scheduled to be paid out prior to the insured’s passing, there may be options that can be explored today to alleviate this issue in the future. A careful review of the policy, including the fine print, and a better understanding of the policy’s projected performance is what is required to ensure the policy will be there when the insured needs it the most. Furthermore, transparency and full disclosure at the time of the sale will make sure the policyowner knows exactly what he or she is purchasing.

We remain focused on working hard to set ourselves apart in the marketplace by delivering the value our Clients and Advisors have come to expect from us. If you have any clients with this or a similar type of policy, we would be happy to perform a review to determine the impact these provisions or changes may have on their policies.

Note: Experience of clients with life insurance products will depend on their unique facts and circumstances and we cannot guarantee the same results for all clients.

File #1173-2017