As 2017 drew to a close, Congress passed the Tax Cuts and Jobs Act (the “Act”), tax reform legislation that made sweeping changes to the Internal Revenue Code. When Congress last reformed the tax code in 1986, the legislative process took over two years. This time Congress accomplished the same feat in two months.

This white paper discusses the portions of the Tax Cuts and Jobs Act that are of particular importance to business owners, investors, and financial advisors. We point out situations that are likely to fare better and those likely to fare worse under the legislation. At the end, we present a chart of “winners and losers ” that takes into account these individual situations. The chart also shows business and economic sectors particularly likely to be affected by these tax changes, thereby potentially altering their equity valuations.

The Act’s provisions contain nuances that present a number of potential opportunities and pitfalls. Investors should consult with their financial and other professional advisors to determine what responsive actions, if any, make sense in their cases.

Congressional Procedure for Passage

The Republicans passed the Tax Cut and Jobs Act without Democratic support. That was not a problem in the House, where the Republicans have a strong majority. But the procedural rules of the Senate made passage there without Democratic votes more challenging.

Normally, under the rules of the Senate, sixty votes (and thus some Democrats’ support) are needed to overcome a filibuster and pass legislation. However, the Senate has adopted a procedure, called “reconciliation”, which if followed permits the chamber to pass tax legislation with a simple majority. To comply with the arcane rules of reconciliation, the Tax Cut and Jobs Act could lose no more than $1.5 trillion of government revenue during the next ten years, and could not lose any revenue after that ten-year period.

Congress crafted the Act to meet the second prong of these requirements by having many of the tax cuts expire. But the first prong was more problematic. The reduction in corporate tax rates alone is estimated to lose close to $1.5 trillion in revenue. Thus, virtually every dollar of additional tax cuts (say, for individuals and families) had to be offset with an additional dollar of new tax revenue.

As a result of this process, and the broad spectrum of individual tax situations, the Tax Cut and Jobs Act is not an unalloyed benefit for everyone. There are winners and losers, as changes to deductions and exemptions fall unevenly across economic sectors, businesses, and individual taxpayers.

Following is a summary of the portions of the Act most likely to affect investors. Unless otherwise noted, these changes are effective January 1, 2018.

Tax Changes for Individuals

Among others, the Act makes the following changes affecting individuals and families:

Tax rates: The Act lowers the top individual tax rate from 39.6% to 37%, and applies the top tax rate to joint incomes over $600,000 (up from $470,700 under prior law). For single filers, the top tax rate applies to incomes over $500,000 (up from $418,400 under prior law). To comply with the reconciliation rules, the lower tax rates expire after 2025.

The Act changes the inflation index used to increase the income levels at which progressively higher tax rates take effect. The Act substitutes the “chained” CPI for the standard CPI used under prior law. “Chained” CPI acknowledges that consumers might switch to less expensive alternative goods when the prices of some goods get too high. (For instance, if the price of beef is too high, consumers may switch to less expensive chicken.) Chained CPI increases less quickly than unchained CPI. As a result, under the Act the income levels will not increase as quickly, potentially forcing taxpayers into higher tax brackets as their incomes increase due to inflation (a process called “bracket creep”).

- Investment taxes: The Act does not change the 20% top tax rate on dividends and capital gains, or the 3.8% surtax on investment income imposed by the Affordable Care Act (Obamacare).

The final legislation does not include the Senate bill provision that would have required investors to compute taxable gain on a sale of securities with reference to their oldest shares (FIFO). Thus, investors remain free to minimize taxable gain by choosing to sell first those lots with the highest basis.

- Personal exemption and child credit: The Act eliminates the personal exemption. Instead, the Act increases the child credit to $2000, of which up to $1400 is refundable, and adds a $500 credit for other dependents. These credits are available only through 2025. Also, the credits phase out (become unavailable) for joint incomes over $400,000 (up from $110,000).

- Standard deduction: The Act roughly doubles the standard deduction to $24,000 for joint filers ($12,000 for single filers), a simplification measure that allows more people to avoid itemizing. The House Ways & Means Committee estimates that the increase in the standard deduction will reduce the number of taxpayers who itemize from roughlyone-third to fewer than 10 percent. Committee on Ways and Means, Tax Cuts and Jobs Act Section by Section Summary (November 2017).

This change in the standard deduction, along with the curtailment of deductions for interest expense and property taxes described below, has raised concerns that the Act will adversely affect real estate values. Additional taxpayers claiming the higher standard deduction have no tax incentive to pay mortgage interest or higher property taxes, and those who do continue to itemize will get reduced federal tax benefits from incurring those expenses. See New Tax Law Expected to Slow Rise of Home Values, Washington Post (December 29, 2017).

- State and local taxes: Under the Act, individuals may no longer deduct state and local taxes in excess of $10,000 annually. Businesses may continue to deduct state and local taxes. Investors should scrutinize their state and local tax payments to determine if any might be regarded as business-related.

- Mortgage interest: The Act reduces the mortgage amount on which interest paid may be deducted from $1 million to $750,000. The deduction is retained for second home mortgages, but not for home equity lines of credit. Existing home mortgages are grandfathered (up to the prior loan eligibility amount of $1,000,000). The disallowance for interest paid on home equity lines of credit applies to interest paid beginning in 2018, including interest paid on existing line of credit borrowings.

Investors who hold large cash positions and are considering the purchase of a home should discuss with their financial professionals the advisability of keeping their mortgage balance under $750,000, or even of making an all-cash purchase and claiming the newly increased standard deduction.

- Charitable contributions: The Act does not change the general deduction for charitable contributions. The Act increases the percentage of current year income from which charitable contributions may be deducted from 50% to 60%.

The reduction in tax rates, doubling of the standard deduction (prompting fewer taxpayers to itemize), and increase in the estate tax exclusion all reduce the tax incentives to make charitable contributions. For that reason, charitable organizations are concerned that the legislation will adversely affect the amount of donations they receive.

- Medical expenses: The Act retains the deduction for medical expenses. Moreover, medical expenses incurred in 2018 and 2019 are deductible to the extent they exceed 7.5% of adjusted gross income, rather than the 10% AGI limit in place in prior years (and which is scheduled to be in place again in 2020).

- Casualty losses: The Act disallows deductions for casualty losses, except for losses arising from causalities that are declared disasters by the president.

- Miscellaneous itemized deductions: The Act repeals the miscellaneous itemized deductions subject to the 2% floor. This repeal includes the deduction for investment fees and expenses available under prior law.

Mutual fund investors effectively may continue to deduct management fees as such fees are netted against the fund’s distributable taxable income. On the other hand, the ability to harvest losses and manage taxes remains a significant advantage of separately managed accounts. Investors should review with their advisors the form of investment that provides the greatest after-tax benefit in their situation.

- Limit on itemized deductions: As a simplification measure, the Act repeals the limitation on itemized deductions imposed on high-income taxpayers under prior law (known as the “Pease limit”).

- AMT: The Act does not repeal the individual alternative minimum tax (AMT), but it increases the exemption amount from $84,500 to $109,400 (joint returns) so fewer taxpayers are subject. The Act also significantly increases the beginning of the exemption phase-out from $160,000 to $1,000,000 (joint returns). These changes are in effect only through 2025 (to comply with reconciliation rules).

- Estate tax: The Act doubles the estate tax and generation skipping tax exclusion to $11.2 million per person ($22.4 million for a married couple) through 2025. (The Act does not adopt the House bill’s repeal of the estate tax beginning in 2024.)The Act retains the current “stepped up basis” rules that allow an heir to sell inherited assets without paying capital gains tax on appreciation that occurred during the deceased’s lifetime.

- 529 plans: The Act allows tax-favored 529 distributions to defray the cost of elementary and secondary school expenses up to $10,000 per student annually.

- Retirement plans: Although initial proposals would have made significant changes to the treatment of retirement plan contributions, the final legislation includes none of these adverse changes. The Act makes one small change, repealing the ability of an individual to recharacterize a Roth IRA contribution as a traditional IRA contribution. Under prior law, an individual making a contribution to an IRA (traditional or Roth) could, before the due date of the income tax return for that year, recharacterize the contribution as made to the other type of IRA (Roth or traditional). The Act repeals the ability to recharacterize a Roth contribution as a traditional IRA contribution, but continues to allow the recharacterization of a traditional IRA contribution as a Roth IRA contribution. This recharacterization could be useful where, for instance, IRA asset values have droppedafter the conversion date. In such a situation, it could make sense to reverse the prior conversion and consider converting at a later time (after an IRS-mandated waiting period) when tax on the conversion would be imposed at a lower asset value.

- Alimony payments: The Act eliminates the deduction for alimony payments. Alimony payments also are no longer includable in the recipient’s taxable income. The Act delays the effective date of this provision for one year, so it applies only to alimony paid pursuant to a divorce or separation agreement executed after December 31, 2018.

- Home sales: The Act does not include the provision in the House and Senate bills that would have tightened the income exclusion on home sales by requiring a taxpayer to own and use a home as a principal residence for five out of the previous eight years to qualify for the exclusion and permitting the exclusion only once every five years.

- Affordable Care Act (Obamacare): The Act eliminates the penalty imposed on people who do not purchase health insurance (the “individual mandate”). This provision is controversial. The non-partisan Congressional Budget Office has concluded that this action will save the federal government over $300 billion in the next decade, but will result in premiums increasing by an additional 10% and 13 million people not continuing their insurance coverage. Congressional Budget Office Cost Estimate, Better Care Reconciliation Act of 2017 (June 26, 2017); CBO Letter to Representative Mike Enzi (July 20, 2017).

Tax Changes for Businesses

Among others, the Act makes the following changes affecting businesses:

- Corporate tax rate: The centerpiece of the Act is a permanent reduction in the tax rate imposed on C corporations from 35% to 21%, beginning January 1, 2018. The Act also repeals the corporate alternative minimum tax (AMT). U.S. corporations currently pay tax at an average effective rate of 18.6%, lower than the new 21% rate. Washington Post, GOP Tax Plan Delivers Mixed Results for Corporate America (November 2, 2017). Thus, some sectors and companies will benefit from the new rate, while others may receive no benefit or even be hurt. The lower tax rate is particularly helpful to retailers, which claim few deductions and thus pay tax close to the full U.S. rate.

- Business income of pass-through entities: Business income earned by pass-through entities (e.g., partnerships, limited liability companies, and S corporations) flows through to the owners’ tax returns, where under prior law it was taxed at ordinary income rates. The Trump Administration, along with the Republican Congressional leadership, sought to reduce that tax to allow smaller businesses to retain more of their profits and grow. The tax writers realized, however, that individuals could abuse this benefit to save taxes on income that is in fact compensation for their services, which should be taxed at full ordinary income rates. For instance, consider a project manager employed by a large company who earns $150,000 per year, which is taxed as ordinary income. If the tax on pass-through income is reduced, the worker could save taxes by forming a consulting LLC and having his former employer contract with the new LLC for his services — even though he is providing exactly the same services for exactly the same company. To prevent this result, the Act curtails the use of the flow-through benefit by owners who also provide services to the business entity. The Act provides a deduction equal to 20% of business income received by owners of a non-service business. Combined with the new 37% top individual tax rate, the deduction results in a top tax rate for eligible pass-through business income of 29.6%. The deduction is available only through 2025. The deduction cannot exceed the greater of (i) 50% of the owner’s pro rata share of wages paid by the entity (including wages paid to both employees and owners), or (ii) the sum of 25% of the owner’s pro rata share of wages paid by the entity (including wages paid to both employees and owners) plus 2.5% of the initial basis of all depreciable tangible property used by the business. Owners of a personal service business may claim the deduction if the owner’s joint income is less than $315,000. (Such owners also are exempt from the 50% wage limitation.) The ability to claim the deduction is phased out for incomes between $315,000 and $415,000, so that owners of a personal service business who have taxable income over 415,000 may not claim the deduction at all. The Act defines personal service businesses to include entities providing financial, brokerage, health, law, accounting, actuarial, or consulting services, but excludes engineering and architecture businesses.

Other considerations of the change to pass-through income include:

- Small 401k plans: Small business owners who are eligible to claim the 20% deduction should re-evaluate with their financial professionals the ongoing tax benefits provided by existing 401(k) plans. Contributions into the plans will produce tax savings at a 29.6% rate, but distributions from the plans are likely to be taxed at higher individual rates. Of course this analysis ignores the significant benefits of tax deferral. If owners conclude that the 401(k) plan produces insufficient ongoing tax benefits, they should consider offering a Roth 401(k) option, which will allow business income to be taxed at the lower rate and participants to withdraw earnings tax-free.

- MLPs: Energy and investment master limited partnerships that qualify for pass through treatment are eligible to claim the 20% deduction, to the extent that the MLP reports taxable income and subject to the limitations on the availability of the – 7 – deduction described above. Some profitable MLPs might consider operating as C corporations to take advantage of the drop in the corporate tax rate, although there are a number of countervailing factors that go into determining whether such a change in structure is advisable.

- Capital expenditures: The Act permits businesses to deduct immediately capital expenditures they make through 2022, rather than, as under prior law, to claim depreciation deductions over the prescribed life of the asset purchased. The write-off expiration date is phased out, reduced by 20% each year through 2026 (entirely phased out in 2027).

- Small businesses: The Act increases the amount small businesses may expense to $1 million, with the expense deduction phasing out beginning at $2.5 million.

- Interest: Under the Act, a business may no longer deduct net interest expense to the extent it exceeds 30% of the business’s income (defined as EBITDA through 2022 and EBIT thereafter). Real estate businesses, and other businesses with gross receipts less than $25 million, are exempt from this disallowance.

- Like kind exchanges: The Act limits tax-deferred “like kind exchange” treatment to exchanges of real property.

- Entertainment expenses: The Act eliminates deductions for business entertainment expenses.

- NOL carryforwards: The Act eliminates net operating loss carrybacks and makes changes to the treatment of loss carryforwards. The Act provides that loss carryforwards may offset only up to 80% of taxable income in any given year. Unused losses may be carried forward indefinitely. Individuals (not corporations) may claim net losses up to $500,000 (joint returns) annually; losses over that amount are subject to the new carryforward rules. The new rules apply to losses arising in 2018 and later years.

- Insurance companies: The Act curtails special tax provisions used by insurance companies to reduce their taxable income.

- Foreign earnings of U.S. multinational companies: Under prior law, a foreign subsidiary’s earnings were subject to a 35% U.S. tax when the subsidiary repatriated the earnings to its U.S. parent. To avoid this tax, many U.S. companies left their earnings overseas with their subsidiaries. The Act provides that future earnings of foreign subsidiaries will no longer be subject to tax on repatriation. Earnings that U.S. companies are currently holding offshore are deemed to be repatriated and subject to U.S. tax at a rate of 15.5% for liquid assets and 8% for illiquid assets, payable over eight years. Existing offshore earnings are taxed regardless of whether foreign subsidiaries actually repatriate those earnings. As a practical matter, once the earnings have been so taxed, the U.S. parent is likely to repatriate them as doing so will incur no additional tax.

- Base erosion: The Act includes provisions aimed at multinational companies that hold valuable intellectual and other intangible property offshore to avoid U.S. tax, an arrangement common in the technology and pharmaceutical sectors. These firms often locate their intangible property in tax haven jurisdictions that impose no or little tax. They then require their U.S. company to pay a royalty or other amount to the foreign affiliate for the domestic use of the intangible property. The group obtained a tax deduction in the U.S. for the payment without owing a corresponding tax on the receipt of that payment in the haven jurisdiction. The Act seeks to thwart this scheme in various ways, such as by imposing a minimum tax on foreign earnings of U.S. multinational companies and by effectively disallowing a full tax deduction for payments made by a U.S. company to a foreign affiliate for the use of intangible and other designated property.

Winners and Losers

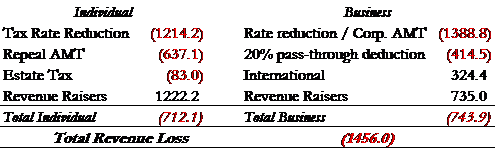

Following is a chart showing (in billions of dollars) how much each of the major provisions of the Tax Cut and Jobs Act increases or decreases federal revenue.

Source: Joint Committee on Taxation, Estimated Budget Effects of the Conference Agreement for H.R. 1, The “Tax Cuts and Jobs Act”(December 2017).

Recall that, under the Senate reconciliation rules, the Act may lose no more than $1.5 trillion over the next ten years. The bill comes in just under that amount at $1.456 trillion. Note also that the corporate tax rate reduction 35% to 21% and elimination of the corporate alternative minimum tax costs $1.389trillion, indicating that the corporate tax cut uses over 95% of the entire revenue loss allotment. Accordingly, all of the other provisions in the bill essentially must be revenue neutral in the aggregate: every dollar of revenue lost must be offset by a dollar of revenue gained. A taxpayer thus might end up paying less tax, more tax, or the same tax depending on how the gainers and losers apply to his or her situation.

A glance at the chart suggests that investors may pay significantly less tax if they (i) currently pay alternative minimum tax, (ii) have large estates and are actuarially likely to die in the next few years, or (iii) own a pass-through business other than a service business. Other investors may not fare so well; they should examine their situation carefully to see if the benefit of the reduction in tax rates exceeds the cost of eliminated deductions.

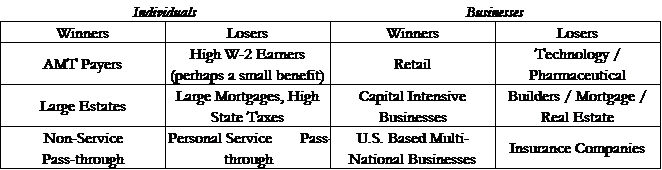

The following chart summarizes these findings. In addition to considering tax changes to individuals, the chart shows economic sectors that are likely to incur significant tax changes that could alter their stock valuations.

A final note on state taxes

Most states use federal adjusted gross or taxable income as the starting point for imposing state tax. States then reduce or increase the federal amount for particular state items. In those states, the expansion of the federal tax base arising from the elimination of deductions is likely to increase the state tax base as well –but without a corresponding reduction in the state tax rate. Thus, many investors may find that, although their federal tax is lower, their state tax has increased.

Conclusion

The Tax Cuts and Jobs Act makes sweeping changes that are likely to impact businesses and investor decisions significantly now and in the coming years. The nuances of the Act present a number of potential opportunities and pitfalls. Investors should consult with their professional advisors to determine how the legislation will alter the tax due in their particular situation, both now and in the future when many of the provisions are slated to expire. They also should discuss with their advisors what actions, if any, they might consider to take advantage (or blunt the adverse effects) of the Act’s provisions in their cases.

Note: This information does not reflect the political views of WealthPoint, LLC or any of its employees or affiliates. WealthPoint, LLC does not provide any tax or legal advice. The discussion herein is general in nature and is provided for informational purposes only. There is no guarantee as to its accuracy or completeness. It is not intended as legal or tax advice and individuals may not rely upon it (including for purposes of avoiding tax penalties imposed by the IRS or state and local tax authorities). Individuals should consult their own legal and tax counsel as to matters discussed herein and before entering into any estate planning, trust, investment, retirement, or insurance arrangement.

Andrew H. Friedman is the founder and principal of The Washington Update LLC and a former senior partner in a Washington, D.C. law firm. He and his colleague Jeff Bush speak regularly on legislative and regulatory developments and trends affecting investment, insurance, and retirement products. They may be reached at www.TheWashingtonUpdate.com.

Copyright Andrew H. Friedman 2018. Reprinted by permission. All rights reserved.

File #0017-2018